Can the concept of saving during ones working lifetime in order to provide financial security in retirement really be that complicated?

It’s not rocket science so why is it beginning to seem like it? It never fails to amaze me just how complicated the pensions world has become.

The complexities seem to increase at an exponential rate with each passing budget, Finance Bill, Finance Act and Pensions Act and it is the role of the Financial Advisor and the Pensions Advisor to elucidate and explain these complexities to the general public which is no mean feat in the current environment.

A whistle-stop tour of the Irish pension world and its burgeoning level of complexities

A whistle-stop tour of the Irish pension world and its burgeoning level of complexities

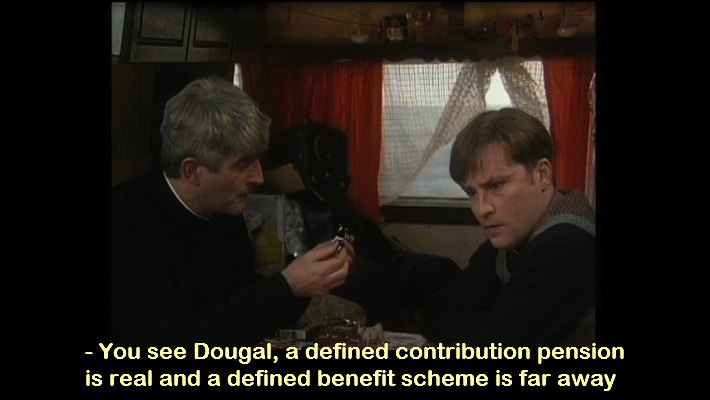

Occupational pension schemes today can be categorised as Defined Benefit (DB) or Defined Contribution (DC) schemes, each type with its own rules and regulations.

Sole Traders and individuals in non-pensionable employment who wish to fund a pension have a choice between Personal Pensions and Personal Retirement Savings Accounts (PRSAs). (Interestingly, a PRSA has some attributes of a company pension scheme and some attributes of a Personal Pension. Occupational schemes are trust based while group or individual PRSAs are not.)

Trust-based schemes must have trustees who have duties and responsibilities and who must undergo trustee training.

Legislation introduced a variety of new rules for employers who don’t have an occupational pension scheme. Such employers must allow their staff access to at least one Standard PRSA (did I mention PRSAS can be standard or non-standard?).

Early retirement is permitted for most occupational schemes but isn’t allowed if you own a Personal Pension unless of course the early retirement is due to ill health. The ability to avail of early retirement from a PRSA depends on your status, not when you were contributing to it but when you go to access benefits.

Proprietary directors have their very own set of pension rules but a distinction is made between a 5% director and a 20% director, each with their own nuanced pension rules. As well as active pension schemes, we also have preserved pensions, deferred pensions, paid up pensions, frozen pensions, guaranteed pensions, state pension and trivial pensions!

Tax treatment, access rules, transfer rules and the 1990 Pensions Act

The tax treatment of contributions varies widely depending on the pension structure used. Access rules also vary widely depending on the structure used and the status of the pension saver.

Retirement options vary depending on whether the scheme is DB or DC, the rules of the scheme and whether the member left their scheme before 6th February 2011 or after 6th February 2011.*

*New ARFAMRF options are available also from Buy out Bonds since 6th February 2011 assuming rules of the purchasing scheme allowed such options.

Transferring from one type of pension to another introduces a plethora of choices with advantages and disadvantages to almost every transfer choice. PRSAs have onerous transfer rules in the case of transfers from occupational pension schemes where usually a document known as a Transfer Certificate is required.

The 1990 Pensions Act was introduced to regulate occupational pensions and the Pensions Board was established to oversee this regulation.

Pensions restrictions

An earnings cap first, then a pension fund cap called a Standard Fund Threshold (SFT), a second threshold called a Personal fund Threshold (PFT) if your fund was higher than the SFT on the date the cap was introduced and finally a cap on the tax free cash of €200,000.

In determining whether you are affected by the SFT, PFT or the tax-free cash cap, you must examine all benefits received since 7th December 2005 and value them.

A retirement is no longer merely a retirement but is now also a ‘Benefit Crystallisation Event’ (BCE) which can trigger a significant tax liability if the Standard Fund Threshold or Personal Fund Thresholds are breached. However, the 2012 Finance Bill has introduced a number of options for how people can foot this tax bill but some options are only available to public servants and some available to all.

Annual management charge, basis points and the Government Levy

There was a time an annual management charge of 0.75% was exactly that. Somewhere along the line it became seventy five basis points. The new Government levy is set at 0.6% of fund values (or should I say sixty basis points) each year up to and including 2014*.

*Pre retirement products only. For Defined Benefits schemes it may or may not reduce pensions in payment depending on how the trustees decide to handle it.

Vested PRSA’s, AMRF’s, ARF’s draw-downs and death benefits

PRSAs can be turned into Vested PRSAs if the tax-free cash is accessed.

Approved Retirement Funds and Vested PRSA’s are subject to an imputed distribution if the holder is over age 60 (it only applies if the policyholder is over the age of 60 for the entire income tax year) and where a withdrawal of less than 5% of the value as at 30th November is made from the fund annually (the rate is 6% where the total value of ARF(s)/Vested PRSA(s) held by an individual is over €2 million).

AMRF’s can be turned into ARF’s under certain conditions but only if a certain level of specified income is involved or if the client reaches age 75 (only certain types of income qualify as specified income).

The amount of specified income depends on whether your AMRF is pre or post 6th February 2011. If you satisfy the AMRF requirements, you have the option to draw down the balance subject to PAYE instead of investing in an ARF or you can partly draw down and partly invest in an ARF!

The type of death benefit and tax treatment of the death benefit associated with pension policies depends very much on the type of pension policy you have and of course depending on whether it’s a pre-retirement policy or a post retirement policy.

Tax-free cash and annuities

Tax-free cash can in some cases be 25% of the fund or, if an occupational scheme then the tax free cash can also be based on a 3/80ths basic scale or an enhanced uplifted scale but if the uplifted scale is used, then retained tax free cash must be deducted from it (all subject to the overall €200,000 limit).

Also, if it is a DC Scheme and you opt for service and earnings-related tax free cash, you must buy an annuity with the balance of your fund except for the AVC part, if any, which you may invest in an AMRF or ARF.

If you want ARF/AMRF options with your main fund, the rules of the scheme must allow it and your tax free cash choice must be 25% of the fund.

For those who have to buy annuities there is a choice of single life, joint life, escalating or level with optional guarantee periods of between zero to ten years. If joint life, you may have your annuity with or without overlap.

Trivial pensions and pension structures

Mind you if your fund is small enough, you may benefit from a trivial benefit rule but only if all your pension funds are within a certain limit. The trivial benefit rule allows two options one with a 10% tax liability and another subject to PAYE marginal rate tax.

In funding your pension you can typically choose between low risk, medium or high risk investment funds (or a combination of all three). Some schemes may also offer options around life styling, deposits, self-directed or self-administered investments

So that’s a small flavour of how complex the simple concept of saving for retirement can get and I haven’t even touched upon all the peripheral subjects which pensions tend to overlap with, such as taxation, family law, employment law, succession, Social Welfare, bankruptcy, company law and accountancy to name but some.

Abbreviations, shorthand, acrostics and acronyms

All of this serves to highlight the urgent requirement to simplify matters. Pensions will probably never be that simple but surely some kind of uniformity could be brought to bear around retirement options, access rules and tax reliefs.

As an industry we are in danger of bewildering the general public to the point where they will give up on pension’s altogether.

Exacerbating matters is our industry’s ability to use our very own code of abbreviations, shorthand, acrostics and acronyms to describe our products and the pension rules.

So, on a daily basis, we unwittingly hear and use repeatedly letters such as ‘AVCs, PRSAs, PPPs, EPPs, AVC PRSA, BOBs, SFTs, PFTs, BCEs, AMRFs, ARFs, PAOs, OAPs, NRA, CFs, RIY, EMVs, AER, TLA, SPDIR, SPDIS, AFC to name just a tiny few from a typical day’s work!!

Pensions are challenging enough right now without the industry becoming its own worst enemy. We need far more uniformity, simplicity and commonality amongst pension structures and products. Pensions should not be such an esoteric subject.

Hard to believe, isn’t it, that at the end of the day, it all boils down to saving money during your working life in order to have money available when you retire from working. How did such a simple concept get so convoluted ?

For Simplified Pension Advice call Ocean on (01) 8693400 and ask to speak with one of our Simplified Pension Advisors!