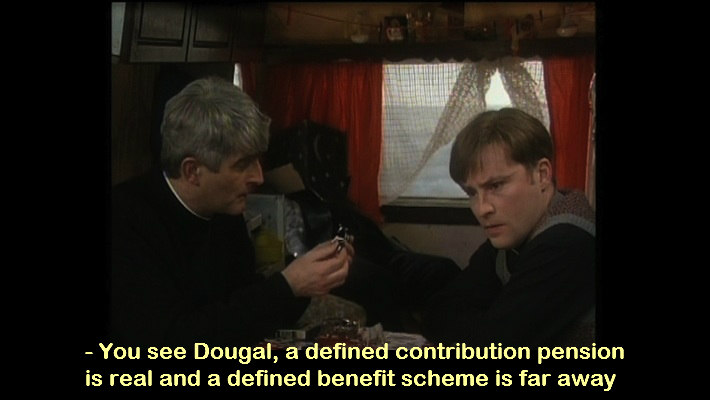

What is better, a Defined Benefit (DB) pension or a Defined Contribution (DC) pension?

If you had asked that question a number of years ago the answer would have been the Defined Benefit scheme by a country mile. A pension that gave you a ‘guaranteed pension’ when you reached retirement age or a pension that depended on how much you contributed and on how your fund performed. It was as you would say a no-brainer for many people.

Waterford Crystal case shatters pensions illusions

That has all changed in recent years and the events that occurred with Waterford Crystal has open many people’s eyes to the fact that the ‘guaranteed pension’ they thought they had is only as secure as the company backing the guarantee.

When Waterford Wedgewood went into receivership in 2009 the pension fund was wound up. In some cases members were left with a pension of less than 20% of what they were expecting. The nearly 1,700 Waterford employees had to go to Europe to try and secure some of their so called ‘guaranteed pension’ and it is left now left to the government to decide what portion they will receive.

Pension alarm bells

For many people this has set off alarm bells. Maybe after working 30 or 40 years for one employer that retirement is not as secure as they thought.

Now they must make a call on their employer and whether this gold-plated scheme will still be available when they come to retirement.

Will the employer still be around and therefore will the scheme be definitely in place when they hit 65? Is there a queue of members ahead of them that are likely to retire before them and therefore reduce the pot for those left behind?

Running Deficits, Running Scared

From the employers’ point of view many of them are running scared. The Defined Benefit scheme can be viewed as an open ended liability as they have no control over how long people will live and so ultimately how much the pension will cost.

With 80-90% of all DB schemes currently in deficit most companies have closed their schemes to new entrants and are actively looking at options to reduce their exposure. Many are offering special deals to existing members to encourage them to switch out of these schemes and into their own defined contribution scheme.

Obviously there are pros and cons to a switch out of a Defined Benefit scheme but it is definitely a discussion you should have with your financial advisor. It might be the case that a Defined Contribution Scheme could be the one for you. At least you will have certainty in knowing that the fund at retirement will be solely based on contributions you and your employer made and obviously the fund’s performance.

In that regard regular reviews are advised in order to insure the investment strategy is in line with your expectations. Although you wouldn’t have thought so based on the media comment over the last few years but pensions funds on average have not performed too badly.

OCEAN ARE A RECOMMENDED PENSIONS ADVISER SPECIALIZING IN HELPING PEOPLE TO SWITCH TO MORE AFFORDABLE PENSIONS WITH MUCH BETTER RETURNS. CALL 01 8693400 FOR A FREE FRIENDLY CHAT TODAY