Pensions are often associated with complexity and confusion, funds and fees.

- How do I get started, how much will it cost?

- How much will I have or need in retirement?

- Can I figure it out myself or is there someone I can trust to give me honest advice and help to get going?

This stripped down guide below will help you understand the basics at a glance.

Call 01-8693400 for further advice from qualified financial advisers Philip Doyle and Ian Heffernan

You can also use the enquiry form here.

See also our comparative anlaysis of best Irish pension fund manager performance

3 Reasons why you should set up a pension

- A pension is really just a savings account for when you are older and in retirement. If you are happy to live out your life after age 65 with a potential €230 per week (for all your expenses), then a pension is not for you. If you think you will need more than this, you need to save to supplement these figures.

- Many people are unhappy when they look at their payslips every week/month and see the huge amount of tax that the government take in the form of PAYE. There are very few ways to get around paying this tax. Paying into a pension will reduce your tax bill and allow you to save this money for yourself and your retirement

- When you save in a bank account with a 1% p.a. deposit rate, you will get hit with tax on this 1% growth of 33%. This also applies to most investments you have. One third of the growth wiped out with tax straight away. Not only are your contributions into a pension shielded from PAYE, the growth inside a pension is also tax free. This makes a huge difference over time compared to a standard investment.

…and 3 reasons why maybe you shouldn’t

- If you are unemployed, you will not be eligible to take out a pension.

- If you cant afford to save every month for your retirement

- If you really enjoy paying huge amounts of income tax in every paycheck!

Get your own pension review by using the online form below

You can choose to get a review on an existing pension and/or enquire about setting up a new plan.

How to set up a realistic retirement wealth goal

e.g. do a raw spreadsheet assuming 6% gain over next 20/30/40 yrs respectively which I then can render into an infographic (perhaps one set of figures incorporating tax savings and another set looking at compounding effect etc)

I don’t have such a spreadsheet. The idea behind a pension is to save as much as you possible can to have the best retirement possible on retirement within your revenue thresholds

How to calculate how much you should invest per month vs how much you can afford to invest per month.

You should invest as much as you can to take as much advantage of the generous current tax relief offered by the government. This will give you the biggest pot possible.

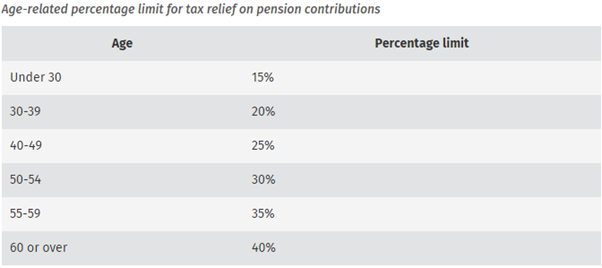

Revenue have contribution limits on some pensions (eg personal pension and PRSA). This is linked to your age and the table is below.

What are the different types of pension plan legal structures available to you (i.e. depending on your personal/work circumstances).

e.g. include a brief overview of PRSA, personal pension, company schemes, Self-administered etc – each as bullet points

Personal Pension or PRSA is a type of pension suitable for self-employed people and people who have no pension scheme with their employer. Sometimes your employer will offer their own PRSA scheme for staff

Company scheme will generally be contributed to from your side and the employer side

What pension funds are available in Ireland for the ordinary investor?

There are hundreds of different funds to choose from when investing in a pension. This is really where good advice can make a big difference to the size of your “pot” on retirement.

The funds are ranked according to risk from 1 to 7 (ESMA scale), with 1 being the lowest risk (cash) and 7 being the highest risk equity fund. Generally, people are somewhere in the middle. They realise that some risk needs to be taken in order for the fund to grow but not too much risk that any potential losses are too high.

The middle of the road funds are generally made up of a mixture of cash, bonds, equities (stocks and shares) and commodities (gold, copper etc.). this idea behind these funds is that all your fund is not invested in the same asset class so if there is a drop in the equities market, the gold price might go up, for example.

How to decide whether to invest in a ‘safety first’ fund or a more risky fund

Generally, here we go through a risk profiling questionnaire with a client and from that we will know what level of risk is suitable so we can advise on funds in and around this level. If, for example, the questionnaire put you at a 3/7 risk profile, we would show you the 2/3 and 4 out of 7 funds and might build a portfolio with some exposure to funds at all 3 levels in order to have a balanced portfolio with a good chance at growth whilst hopefully limiting the downside..

How to decide which pension fund manager to invest your pension with

Every month/quarter, the life insurance companies put out figures of their performance figures. Over the long term, we can see purely by the numbers which funds have done best and who the best companies are to invest in a pension with.

Understanding management fees and allocation rates

e.g. a brief outline of same and evocation of how brokers can help get these compounding opportunity costs down.

There are generally 3 types of fees when it comes to pensions

- Monthly policy fee.

This is a flat monthly fee (usually between €3-€6). You will find this on most pension plans

- Annual management charge

This is a % fee taken from your pension every year and paid to the fund managers for managing your funds. This fee can be anywhere from 0.5% to 2% per annum depending on the fund and the broker

- Allocation charge

This charge is typically found in a PRSA and is a % charge on the money going in to the pension. The rate for a standard PRSA is 5%. This means if you contribute €100, €95 is invested in the pension and €5 goes to charges

Whilst it is important to consider fees when taking out a pension, fees come second to fund choice and performance. The difference between funds at the same risk level can be 5% per annum or more depending on the fund manager. This would more than make up a potential difference in fees of maybe 1% from one provider and another.

How to make regular contributions and lump sum top-ups

e.g. when you get five grand windfall from deceased Aunt Sally

A standard pension is taken out and started with monthly regular contribution. This amount can be increased/decreased as you move through life depending on your budget/circumstances. You have a revenue limit on what % you can put into your pension every year from your gross salary depending on your age.

If you haven’t used up your full revenue limit through regular contributions and wish to take advantage or some/all of your remaining tax relief, you can choose to add a lump sum into your pension.

Understanding the key differences between an ‘investment’ and a ‘pension plan’

e.g. same funds albeit different treatment re taxation / drawdown issues

Pension and investment are very similar. The main differences are;

- Pension contributions are subject to PAYE tax relief

- Growth in a pension is not taxed

- Pensions have a defined age before which you cannot draw the benefits out

Investment on the other hand is done with after tax monies (already 20%-40% less due to PAYE).

Growth in an investment is generally taxed at 33%

You can generally take the funds from an investment at any time (may be subject to penalties though)

Understanding the tax advantages from a pension plan as you get older

e.g. increasingly better tax avoidance per annual income

As you get older, generally your income will rise. You will also often find yourself with less financial responsibilities (mortgage paid off, children finished college). This is usually when people start thinking really seriously about retirement and crucially now have the funds to do something substantial about it. The older you are the bigger % of your gross salary that revenue will allow you to contribute to the pension and get PAYE tax relief. This figure goes as high as 40% of your gross salary in your 60s..

How to estimate how much you might realistically ‘earn’ from your pension

How to reduce ‘commitment anxiety’ which can delay your decision to start a pension

e.g. ‘Just do it’ , it’s easy to set up because we will do the heavy lifting paperwork crap for you, if you hit hard times you can suspend your pay-in etc etc [we basically need to counteract the inertia which many people feel about making a lifelong commitment}

The problem we find with people getting started is that they keep putting it on the back burner. They presume that it will cost too much. They worry about fees or tax or whatever. The only thing that is certain is that if you don’t do anything about it, you will have no extra income in retirement.

Getting started is really easy, it only takes a few minutes over the phone. You can increase/decrease/stop your payments when it suits you so it is flexible. We don’t use complicated jargon and will explain it to you in a way you can understand. We will be there on the other end of the phone all the way through to answer any questions you might have too. It really is just a case of getting started and being disciplined every month. “Old” you will thank “young” you for doing it when you are living your best life in retirement

How to cash out a pension early (if you need to)

Revenue have specific ages to cash in pensions. It is generally any time from 60 years old, but there are some schemes that may be able to be taken from age 50 onwards. It really depends on the scheme you are in

How to transfer a pension

e.g. how to transfer one you already have and/or how to transfer the pension you about to set up with us i.e, in the future if you feel you want/need to (i.e. you are not stuck with us nor our recommended lifeco fund)

As previously discussed, there can be a big difference in the performance of the funds of one life company over another. Most pensions can be moved from place to place. People generally do this looking for a higher return on their funds. It is something to be considered carefully to make sure it is the correct move for you. It is something we can certainly help you with by showing you the pros and cons of moving/not moving.

How you can monitor your pension as you invest in it

We are available to help clients 9-5 Monday to Friday with any questions they have in relation to their pension investment. We are happy to review performance at any time.

Generally, you are able to logon to the life company’s website and track the performance of your pension and will be sent a yearly statement showing this too.

If you are unhappy with how your fund/funds are performing, you can usually switch to a different fund free of charge. It is recommended that you seek advice before making such changes.

How to draw down your pension when you reach retirement.

You have many options including Personal Retirement Bonds, Approved Retirement Funds and Annuities – we can advise on the best options including those whereby you can stay invested whilst drawing down a tax free lump sum even if you want to retire relatively early.