Irish Emerging Markets Pension Funds Compared

As Irish pension investors seek long-term growth and diversification, Emerging Markets (EM) Pension Funds have come under increased scrutiny (even if these themed funds have had historically moderate returns hitherto).

These funds invest in developing countries that are undergoing rapid industrialisation and economic growth. But are they suitable for your pension portfolio?

Here, we explore the bull case, the bear case, and the base case – a balanced perspective to help you make an informed decision.

What Are Emerging Markets Pension Funds?

Emerging Markets Pension Funds are investment vehicles that allocate capital to equities, bonds, or mixed assets in countries classified as emerging markets. These include countries such as:

- China

- India

- Brazil

- Mexico

- Indonesia

- Turkey

- South Africa

- Thailand

- Vietnam

These funds typically avoid frontier markets (which are even less developed) and developed markets like the US, UK, Germany, or Japan. The goal is to benefit from the economic catch-up effect and favourable demographic trends in emerging economies.

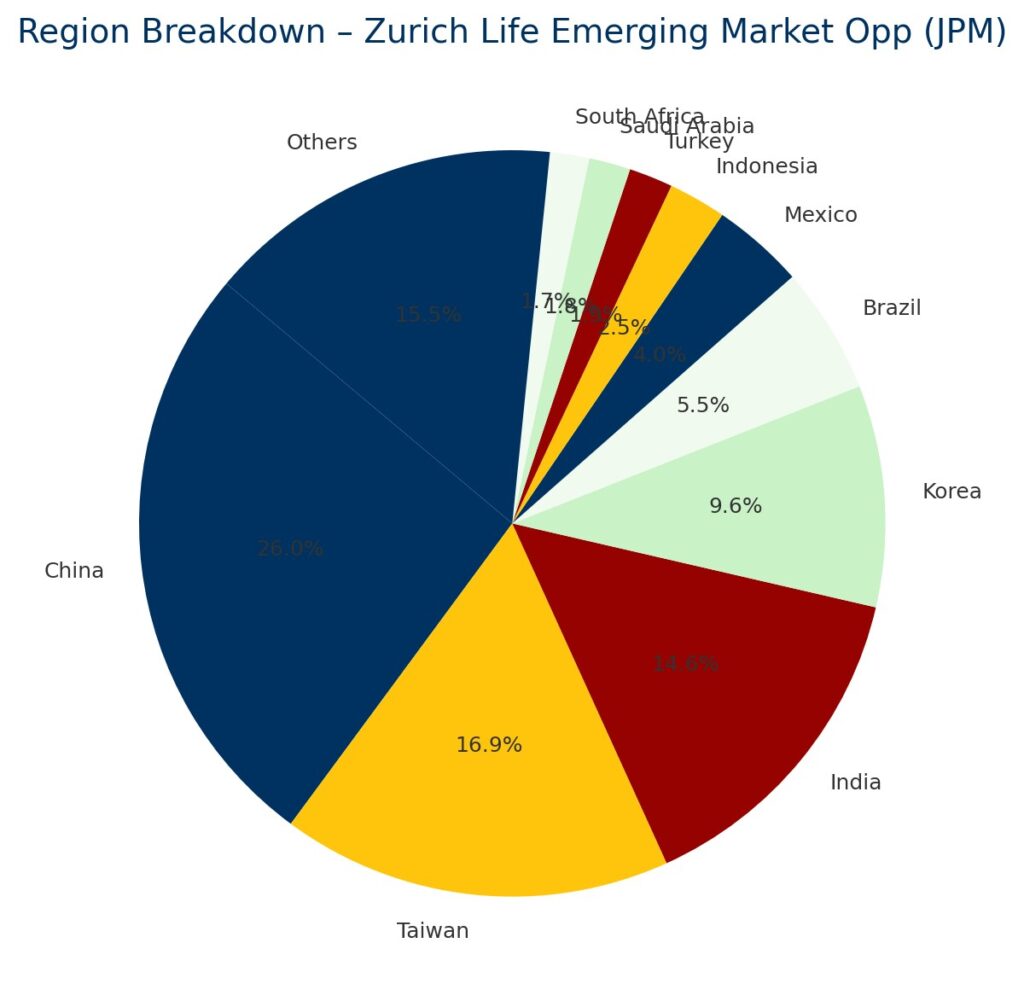

Example of Fund by Region (Zurich / JP Morgan Irish domiciled fund)

Get your own pension review by using the contact options below which suit you

You can choose to get a review on an existing pension and/or enquire about setting up a new plan.

The Bull Case: Why Consider Emerging Markets?

1. Higher Growth Potential

Emerging markets often experience faster GDP growth compared to developed countries. This is due to:

- Young, growing populations

- Expanding middle class

- Increasing consumer spending

- Infrastructure development

These factors can translate into higher corporate earnings growth, which can drive long-term investment returns.

2. Attractive Valuations

Many EM equities are trading at lower price-to-earnings (P/E) ratios than their developed market counterparts. This relative undervaluation may offer a good entry point for long-term investors.

3. Diversification Benefits

Adding EM exposure can diversify your pension portfolio. These markets are influenced by different economic drivers, such as commodity prices and local fiscal policies, which may reduce overall portfolio volatility when combined with developed market holdings.

4. Favourable Demographics

Countries like India and Indonesia have large, young populations entering the workforce. This supports sustained economic expansion, innovation, and consumption growth.

5. Technological Leapfrogging

In many emerging markets, companies are skipping legacy infrastructure and adopting the latest technologies in sectors like fintech, mobile banking, and e-commerce. This rapid evolution can create unique investment opportunities.

The Bear Case: Risks and Challenges

1. Political and Regulatory Risk

Emerging markets are more prone to political instability, corruption, and sudden regulatory changes. For example, government interventions in China’s tech and education sectors have had severe impacts on investor confidence and stock valuations.

2. Currency Volatility

Exchange rate fluctuations can significantly impact returns for Irish investors. EM currencies can be volatile, influenced by global risk sentiment, commodity prices, and domestic inflation.

3. Lower Corporate Governance Standards

While improving, corporate governance and transparency in many EM countries may still lag behind developed markets. This increases the risk of fraud or mismanagement.

4. Liquidity Concerns

Some EM assets are less liquid, meaning it can be harder to sell positions quickly without affecting market prices. This is particularly relevant during periods of market stress.

5. Geopolitical Tensions

Ongoing tensions, such as between the US and China or within regions like the Middle East, can impact investment stability in certain emerging markets.

Alternative Region Focused Funds to Consider

A Balanced Base Case Perspective: Should You Invest in Emerging Markets Funds?

What Type of Investor Are You?

Emerging Markets Pension Funds are not suitable for everyone. They tend to suit:

- Younger Investors with a longer time horizon and higher risk tolerance

- Growth-Oriented Investors seeking to boost long-term returns

- Diversified Portfolios looking for exposure outside of traditional developed markets

They may not be ideal for:

- Conservative Investors seeking capital preservation

- Those nearing retirement, who might prioritise income and lower volatility

What Percentage Should Be Allocated?

A general guideline among financial advisors is to allocate 5% to 15% of an equity portfolio to emerging markets, depending on your overall risk profile. For pension investors, this may be included within a broader global equity allocation or through targeted EM funds.

Active vs Passive EM Funds

- Active Funds: Managers aim to outperform the EM benchmark by selecting the most promising opportunities. These funds may better navigate market volatility and local complexities.

- Passive Funds: Some Irish pension funds track indices like the MSCI Emerging Markets Index. These offer lower fees but expose investors to all constituents, regardless of quality or prospects.

Before putting your eggs in one basket – get advice from a financial broker

You can choose to get a review on an existing pension and/or enquire about setting up a new plan.

Emerging Markets in Today’s Economic Environment

The Case Today

In 2025, the global economic environment presents a mixed picture:

- Slowing growth in developed markets may make EM’s relative growth more appealing.

- Falling interest rates in the US and Europe could benefit EM assets, which are often pressured by strong foreign currencies and high global interest rates.

- Commodity cycles (especially oil and metals) are showing signs of recovery, benefitting EM exporters.

- AI and digital adoption are creating new growth sectors in emerging markets, particularly in areas like India and Southeast Asia.

However, risks remain. China’s economic rebalancing and regulatory environment still cause concern. Geopolitical tensions continue to simmer, and global trade dynamics are evolving in unpredictable ways.

Key Trends to Watch

- De-dollarisation and increasing local currency settlements

- Reshoring of manufacturing and EM participation in new supply chains

- Sustainability: ESG-focused EM funds are gaining traction

Conclusion: Should Emerging Markets Be Part of Your Pension?

Emerging Markets Pension Funds offer exciting growth potential, diversification benefits, and access to dynamic economies. However, these advantages come with significant risks, including political uncertainty, currency volatility, and corporate governance issues.

For the right investor—typically younger, growth-oriented, and long-term focused—EM funds can be a valuable component of a diversified pension portfolio. That said, they should be approached thoughtfully, ideally as a small to moderate allocation within a well-balanced pension plan.

If you’re unsure whether Emerging Markets Pension Funds suit your retirement goals, speak with a qualified pensions advisor at Ocean.ie. We’re here to help you navigate global opportunities while keeping your financial future secure.

Ocean.ie is a regulated pensions and investment broker based in Ireland. This article is for informational purposes only and does not constitute financial advice. Please consult a financial advisor before making any investment decisions.