It’s easy! Compare mortgage protection & life cover quotes from 6 insurers in 30 seconds

The cheapest quote is not always the best deal. With ocean.ie you can choose either the best value option for you or just get the lowest offer!

Enter your details

Simply choose what sort of life cover you want, whether it’s a single or joint policy and how much you want to insure for.

Get Quotes

Within seconds, ocean.ie searches several insurance providers to get the best quote to match your requirements.

Complete Application

Our system will issue you with your new policy documents – if you wish you can check it over with one of our brokers and then get cover!

GET AN INSTANT QUOTE ON YOUR PROTECTION POLICIES NOW. USE THESE COMPARISION TOOLS BELOW TO FIND THE BEST QUOTE FROM ALL INSURANCE COMPANIES

Did you already take out expensive mortgage protection or life cover?

Then you must read this! People who took out policies during the boom years are now being fleeced but you now get the same cover for less money!

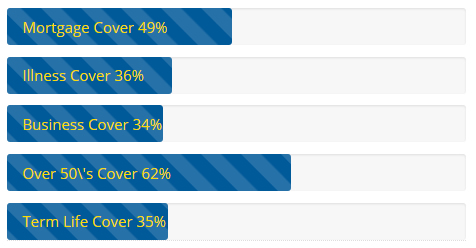

In the last 3 months, these are the average savings for customers who switched their policies with Ocean.ie*

*Data based on policies which were signed off since 30 November 2016

Just a quick email regarding my mortgage protection policy. From the moment I got in contact with Ocean.ie I have found them to be fantastic. Setting up a quotation and getting a figure was so straightforward. Quick, easy and extremely helpful at all times. I cannot believe how much I was paying for my mortgage protection and thanks very much for getting back to me with such a great price. I have and will continue to recommend you to my friends and family. Thanks again!

Men in particular have made big savings because of the EU Gender Directive

Insurance Information Resource Centre

If you are unsure about what policies are suitable for and your family, these guides may help or talk to one of our qualified finance advisers today on 01 8693400.

Mortgage Protection

Mortgage Protection is the type of life policy required by a lender to cover a mortgage or loan in the event of death of the borrower(s). It is generally necessary to have this cover in place before the lender will allow you to draw down the cheque.

We at Ocean.ie shop around all our agencies to get the most competitive quote available for you.

If you are taking out this cover for the first time Ocean Finance can help you arrange the best deal and advise you on the best policy to suit your requirements.

If you already have a mortgage protection policy there is a good chance that you are paying too much. Why not talk to one of our Qualified Financial Advisors today and see how much you can save? It’s never been easier to Switch.

Life Cover

Mortgage Protection is the type of life policy required by a lender to cover a mortgage or loan in the event of death of the borrower(s). It is generally necessary to have this cover in place before the lender will allow you to draw down the cheque.

We at Ocean.ie shop around all our agencies to get the most competitive quote available for you.

If you are taking out this cover for the first time Ocean Finance can help you arrange the best deal and advise you on the best policy to suit your requirements.

If you already have a mortgage protection policy there is a good chance that you are paying too much. Why not talk to one of our Qualified Financial Advisors today and see how much you can save? It’s never been easier to Switch.

Illness

Mortgage Illness Cover or Serious Illness Cover is designed to cover all or part of your mortgage in the event of you being diagnosed with or suffering from a specified illness during the term of your mortgage.

This means that you will have one less thing to worry about as the lump sum is paid out to the lender to reduce or clear your remaining mortgage balance. You have the option of covering part or all of your mortgage with this policy.

This cover can decrease in line with your reducing mortgage balance or you may opt for level cover meaning any surplus above your remaining mortgage balance is payable to you and your family. Talk to Ocean Finance today and see how easy it is to buy peace of mind for the future.

Income

Your income is your most important asset. Protect it and you’ll be able to meet your future cost of living even if illness strikes. What would happen you if you were out of work due to illness or accident? How long would your employer continue to pay you? How long would your savings last? Income Protection helps ensure you have the income you need if you are unable to work due to ill health.

It can:-

- Provide an income for everyday living

- Ensure you continue to meet your monthly mortgage repayments and household bills

- elp you maintain your current standard of living Calculate how much Income Protection you would need.

Business Protection

Most business owners will take steps to minimise risk to their business – insuring property, equipment, vehicles, etc. While these are sensible precautions, what would happen on the death of key people, partners, or directors? Successful companies are made up of people with experience, knowledge, management expertise and vital business contacts. Without these people the business might not succeed. Business Protection is designed to protect a company against some of the costs associated with the death of a key employee, director, or partner, much like business insurance protects against loss of profits resulting from fire or flood.

Depending on the nature of a business, there are three types of Business Protection:

- Co-Directors Insurance

- Partnership Insurance

- Keyperson Insurance

Co-Directors Insurance

The death of a company director can have a serious impact on the surviving directors and the deceased’s successor. Ideally, if there is sufficient cash in the business, the surviving directors would buy out the deceased’s estate. Co-Directors Insurance ensures that this cash is available. Each director takes out a life assurance policy on their own life, in trust for the surviving directors. If a director dies, the surviving directors would then have the cash to enable them to buy back the shares from the deceased’s estate.

Partnership Insurance

The death of a partner can affect a business in different ways. If there is no partnership agreement in place then the partnership could be dissolved in law. If a partnership agreement exists and the partnership is not dissolved, then the surviving partners would become liable to the deceased’s estate for their share of the partnership. With Partnership Insurance, each partner takes out a policy on their own life, in trust for the other partners. Upon the death of a partner, the proceeds of the life policy would then become payable to the surviving partners, enabling them to buy out the deceased’s next of kin.

Keyperson Insurance

The aim of Keyperson Insurance is to protect your company on the death or specified illness of a key employee by paying out on the financial loss incurred by either of these events. The company takes out an insurance policy on the life of that key employee, ideally until retirement age. The company pays the premiums and then receives the benefit if the employee dies or suffers a specified illness.

Over 50's Cover

From just €15 a month, the plan can give your loved ones a guaranteed lump sum to help pay some of the costs they may face after your death, for example any funeral expenses or bills left to pay. Key features

Up to €25,000 cover

Guaranteed acceptance for those aged between 50-80 living in Ireland

No medical questions asked

Payments will never increase or decrease

Guaranteed cover for the rest of your life

Contact us today for more information on this cover at 01-8693400