Fixed income or bond-based pension funds are designed for stability and income, focusing on preserving capital and generating predictable returns.

Unlike aggressively managed funds that pursue capital growth through equities, bond funds prioritise consistency and lower risk, making them an essential component of many long-term pension strategies in Ireland.

Why Do Bond Funds Appear Underwhelming?

Performance Looks Poor Against Equities

Bond fund performance can look underwhelming when compared directly with equity-heavy funds, especially during long bull markets. However, the purpose of fixed income is not to outperform equities — it’s to provide income, stability, and diversification.

Many pension investors fall into the trap of comparing bond fund performance to aggressive growth funds without considering the different roles they play. Judged on capital preservation and lower drawdown risk, bond funds have historically delivered on their promise.

The Impact of Monetary Policy

The 2010s saw unprecedented central bank intervention, driving interest rates to near-zero or even negative territory. Bond yields followed suit, compressing returns for nearly a decade.

However, that era has ended. The current environment of higher nominal yields and normalised central bank policy offers a more balanced risk-return equation for bond investors.

Get your own pension review by using the contact options below which suit you

You can choose to get a review on an existing pension and/or enquire about setting up a new plan.

Here we explore the bull case, bear case, and broader context for bond-based Irish pension funds. We’ll examine who these funds may suit, how they’ve performed, and whether they should form part of a diversified pension portfolio in today’s economic environment.

Bull Case: Why Fixed Income Funds Still Matter

Lower Volatility, Greater Predictability

Bond funds typically carry lower ESMA risk ratings — often 2 to 4 out of 7, compared to 6 or 7 for aggressive equity funds. This lower volatility can be a valuable feature for risk-averse investors or those approaching retirement.

These funds primarily invest in:

- Sovereign Bonds: Irish government bonds, German Bunds, US Treasuries

- Corporate Bonds: Issued by highly rated European or global companies

- Investment Grade Credit: Providing a balance between yield and risk

This investment focus allows bond funds to deliver a steady stream of income, typically through coupon payments, while aiming to preserve capital value.

Income Generation and Capital Preservation

Many investors near or in retirement rely on bond funds for predictable income. While returns may be lower than equities, they are generally more stable. In times of market stress, high-quality bonds often appreciate as investors seek safe havens.

For investors who prioritise capital preservation — for instance, those within 10 years of retirement — bond funds can help reduce overall portfolio risk while offering a modest return.

Diversification within a Pension Portfolio

Fixed income funds are valuable diversifiers in a multi-asset pension strategy. When equities underperform or experience sharp drawdowns, high-quality bonds often provide a counterbalance.

A typical mixed-asset Irish pension fund might allocate 30–60% to fixed income, depending on its risk profile. Including a standalone bond fund in your portfolio may enhance stability or income, especially in volatile or uncertain environments.

Bear Case: The Limitations of Bond-Based Pension Funds

Low Returns Over the Last Decade

Over the past 10–15 years, bond funds have underperformed relative to equities. Ultra-low interest rates, quantitative easing, and low inflation contributed to an extended period of low yields.

In real terms (after inflation), many bond investors saw minimal or even negative returns, particularly in European markets. This is one reason why bond fund performance may appear underwhelming when compared to aggressive equity strategies.

Interest Rate Sensitivity

Bond prices move inversely to interest rates. In a rising rate environment — as seen in 2022 and 2023 — bond prices fall, leading to negative returns.

Many pension investors were surprised by the losses in their bond funds when rates spiked globally following post-COVID inflation. This was especially true for longer-duration bonds, which are more sensitive to interest rate movements.

Limited Exposure to Growth Markets

Bond funds generally do not invest in high-growth sectors or emerging markets. Their focus is on capital stability, meaning they often avoid riskier or more volatile regions.

By contrast, a typical mixed-asset Irish pension fund may include equity exposure to emerging markets or sector-specific opportunities (such as technology or clean energy), offering higher growth potential.

This geographical and asset-class limitation makes fixed income funds less appealing for investors with long horizons or high growth objectives.

The Case for Fixed Income Funds in Today’s Economic Environment

2025 Economic Overview

As of 2025, global inflation has eased, but central banks remain cautious. Interest rates are plateauing or declining slightly in Europe and the US. Bond yields are stabilising, providing a more attractive entry point for fixed income investors compared to just a few years ago.

The eurozone benchmark yield has returned to more normalised levels, offering better coupon income than during the negative-rate era. This has made fixed income more relevant again, particularly for conservative investors.

A Role in Portfolio Rebalancing

After several years of high volatility in equity markets, many investors are rebalancing toward bonds to stabilise their pension allocations. Adding or increasing exposure to fixed income can reduce portfolio risk and create a more defensive posture.

In a world of elevated geopolitical risks and slowing global growth, bonds can provide ballast, helping cushion portfolios against market shocks.

More Attractive Risk-Reward Profile

Today’s bond yields — especially from investment-grade corporate debt and sovereign bonds — are offering better real returns. The entry point for long-term investors is now more favourable than during the ultra-low rate environment of the 2010s.

With the potential for rate cuts on the horizon, capital gains may also return to the bond market as prices rise in response to falling yields.

Fixed Income vs. Mixed Asset Irish Pension Funds

Asset Allocation Comparison

- Fixed Income Funds: Typically invest 70–100% in government and corporate bonds. May include some short-term instruments or high-grade credit.

- Mixed Asset Funds: Hold 30–60% fixed income, with the remainder in equities, property, and alternatives.

Risk Ratings

- Fixed Income Funds: Usually ESMA 2–4 depending on duration and credit exposure

- Mixed Asset Funds: Typically ESMA 3–5

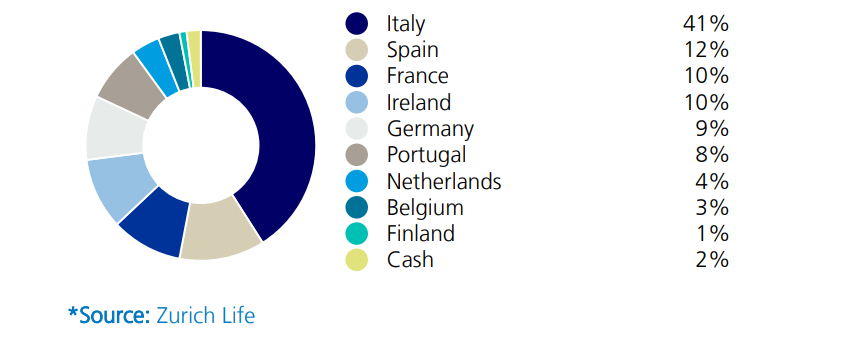

Typical Geographical Exposure

Fixed income funds used in Irish pensions tend to favour:

- Eurozone sovereign debt (especially Irish, German, and French bonds)

- US Treasuries (hedged to euro)

- Global corporate bonds (investment grade only)

By contrast, equity components in mixed-asset funds may reach into:

- Emerging markets (Asia, Latin America, Eastern Europe)

- Sector-specific opportunities (tech, healthcare)

- Small- and mid-cap companies

Who Should Consider Bond-Based Pension Funds?

Suitable Investor Profiles

- Nearing Retirement (Ages 55–65): Seeking lower volatility and capital preservation

- Already Retired: Needing predictable income and low drawdown risk

- Risk-Averse Investors: Prefer slow and steady growth over aggressive strategies

- Diversifiers: Looking to balance equity exposure within a multi-asset pension plan

When Bond Funds May Be Less Suitable

- Young Investors (Ages 20–40): With long time horizons, they may benefit more from equity exposure

- High Risk Tolerance Individuals: Seeking higher returns and willing to ride out volatility

- Inflation-Focused Investors: May prefer assets with stronger inflation protection, such as equities or real assets

Note that over 50’s who are under provisioned for retirement may need better returns

You can choose to get a review on an existing pension and/or enquire about setting up a new plan.

Final Thoughts: Are Fixed Income Funds Worth It?

While they may not grab headlines, bond-based pension funds still play a critical role in financial planning. They offer capital protection, income, and a stabilising presence in any pension portfolio — especially during market turbulence.

Although their performance over the last decade has been muted, this was largely due to artificial monetary conditions. With higher yields, lower inflation, and potential rate cuts ahead, the outlook for bond funds has improved.

At Ocean.ie, we help Irish pension investors create balanced, resilient portfolios tailored to their goals and time horizon. Whether you’re seeking growth, income, or a thoughtful mix of both, we can help you find the right combination.